Russia agreed to bail out Iceland by granting this small island state a huge stabilisation loan at an unbelievably low interest rate.

Russia agreed to bail out Iceland by granting this small island state a huge stabilisation loan at an unbelievably low interest rate. Is it an act of wanton generosity, or a far-sighted geopolitical step? Moreover, in general, 4 billion euros (140.981 billion roubles. 5.366 billion USD. 3.146 billion UK pounds), is it a lot or a little? The fate of Iceland has until recently not concerned Russia one bit. Now, only a lazy person is not discussing the incredible sum the “island of stability” is going to inject into the economy of a sinking island of geysers.

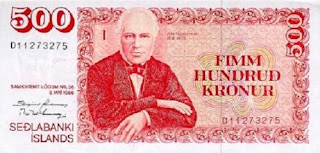

Europe, meanwhile, has been discussing Iceland for a long time. A hedge-fund country, an example of liberal economic regulation, and a model of a rapidly developing economy, Iceland was the first in the world to feel the impact of the full-bodied economic crisis. This happened at the end of 2007. Since this year began, Iceland’s currency, the króna, has lost one-third of its value against the euro. Iceland’s leading banks, Kaupthing, Glitnir and Landsbanki, were marauded by international financial sharks. At the end of September, the country’s authorities bought out (read, nationalised) Glitnir Bank, and, on 7 October, Landsbanki, whilst on the same day Kaupthing Bank received a 500 million euro (17.622 billion roubles. 670.691 million USD. 393.293 million UK pounds) loan from Iceland’s National Bank. By the autumn of 2008, it was clear that Iceland might become the world’s first country to suffer a default.Why is the bubble of Iceland’s economy bursting so loudly? It ballooned too rapidly, the IMF believes. In 2003-2007, the country’s GDP rose by 25 percent, with this robust growth fed mainly by outside borrowing. To attract foreign investments, the authorities strengthened the currency and ratcheted up interest rates (by the beginning of 2008, they were the highest in Europe, 15.5 percent per annum). The result was a monstrous imbalance, that is, a modest GDP, on the one hand, and immense financial assets and tremendous liabilities, on the other. According to 2007 figures, Iceland’s GDP was 16 billion dollars (420.406 billion roubles. 11.928 billion euros. 9.382 billion UK pounds) (1.313 million roubles. 50,000 USD. 37,345 euros. 29,320 UK pounds per capita GDP, some 10 percent higher than the USA: editor’s note), whilst its financial assets stood at 1,000 percent of GDP and an external debt of 550 percent of GDP.

With Iceland teetering on the brink of default, Russia’s stabilisation loan of 4 billion euros is a lifebelt, and a very sizeable one (on the evening of 7 October, Finance Minister Aleksei Kudrin acknowledged Russia’s readiness to pay, although, previously, he had denied such claims by Iceland’s National Bank). Judge for yourself, when, in May 2008, Iceland was drowning, the central banks of three Scandinavian countries, Sweden, Denmark, and Norway, set up a special 2.3 billion dollar (60.433 billion roubles. 1.715 billion euros. 1.349 billion UK pounds) rescue fund for Iceland. Now, Russia alone is ready to fork over two and a half times as much for the same purpose. In other words, 4 billion euros by Iceland’s standards is substantial.

In Russian eyes, it is a vast sum, too. Moreover, it is one pledged at a very fair rate. To judge from a release issued by Iceland’s National Bank, Russia promised it at LIBOR +0.3-0.5 percent. This compares with LIBOR +1 percent at which the Russian Central Bank wants to offer loans to Russia’s Vnesheconombank. Doing this when the Russian government holds crisis emergency meetings almost every day looks strange, to say the least. The man in the street would say this is no time for liberal loans when one’s own existence is at stake. This response would not be quite right, in my opinion. There are several reasons why Russia should agree to issue the loan to Iceland.The first and overwhelming one is geo-economic. Leaders in many countries are gradually beginning to understand that a world caught in the maelstrom of a financial crisis could be saved only by cooperative efforts. This was a theme running through a three-day world policy conference in Évian; it will certainly be taken up at an annual meeting of the International Monetary Fund and World Bank. World Bank chief Robert Zoellick only recently proposed that the G8 also include BRIC countries (Brazil, Russia, India and China), Mexico, Saudi Arabia, and South Africa. World leaders more and more often speak of the need to shelve personal ambitions, put away political squabbles, and do something.To come to the aid of Iceland at such a time was for Russia a decision prompted by stark necessity. Russia has a rich war chest of windfall oil money. By the end of September, its Central Bank had 566 billion dollars (14.871 trillion roubles. 422.745 billion euros. 331.902 billion UK pounds) in international reserves, and 32-plus billion dollars (840.813 billion roubles. 23.901 billion euros. 18.765 billion UK pounds) in the National Welfare Fund and the Reserve Fund. Of course, Russia could sit it out on its “island of stability” and fight the crisis within its four walls. But, in this case, Russia risks suddenly discovering that the global financial storm whipped up even further by Iceland’s hurricane has wiped out all its stockpiled reserves. Most of Iceland’s lenders are European banks. Should Iceland declare a default, the whole of Europe would go into a spin, and would drag Russia after it, which now has a chance to scrape its way out of the crisis the cheap way. It emerges that by saving Iceland, Russia is saving itself first.Other considerations are less global and more pragmatic. Crises come and go, but, allies (sometimes) remain. Iceland, a rapidly developing economy and a happy hunting ground for businessmen from many European countries, is certain to remember this gesture and take more kindly to Russian investments in the future. So far, Russia-Iceland trade has been 100 million dollars (2.627 billion roubles. 74.55 million euros. 58.64 million UK pounds) per year. It was only shortly before the crisis that Russian business (represented by Roman Abramovich and Oleg Deripaska) began exploring the country’s investment possibilities. Now, the price for entering Iceland’s economy could prove very low.